JustBet/WINR Presale

Token presale on Arbitrum for a gaming infrastructure ecosystem.

DETAILS

- Presale Details

- Presale will be held on Camelot launchpad, and will last for 1 day or until sold out

- Note: whitelist have priority access 2 days prior (March 9) to the public sale

- Purchase token: USDC

- Presale price: unknown

- Listing price (max): $0.03

- Vesting: 100% at launch

- Presale token allocation: 50M $WINR / 50M $vWINR

- vWINR can be converted to WINR, see ‘Mechanics & Features’ below

- No soft cap

- Hard cap: $3,000,000

- Maximum buy: $25,000 ($500 for whitelist)

- Initial circulating market cap: $2,500,000

- Presale fund allocation;

- 40% to Protocol Owned Liquidity

- 25% to Marketing

- 25% to Development

- 20% to Floor Price Fund

- Taxes: 0%

- Token listing date: March 13, 2023

- Presale will be held on Camelot launchpad, and will last for 1 day or until sold out

- Mechanics & Features

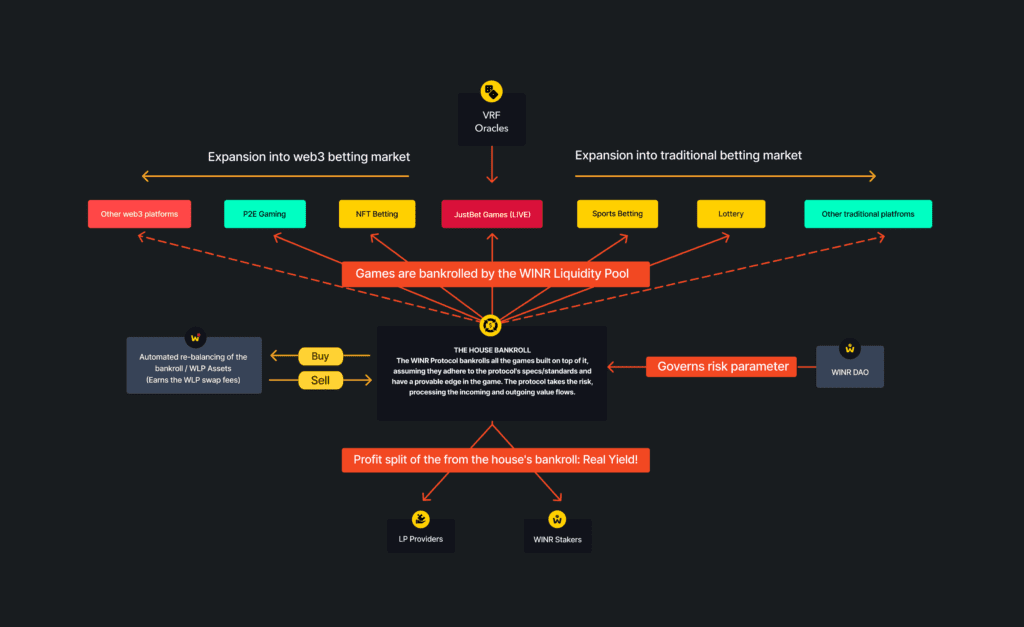

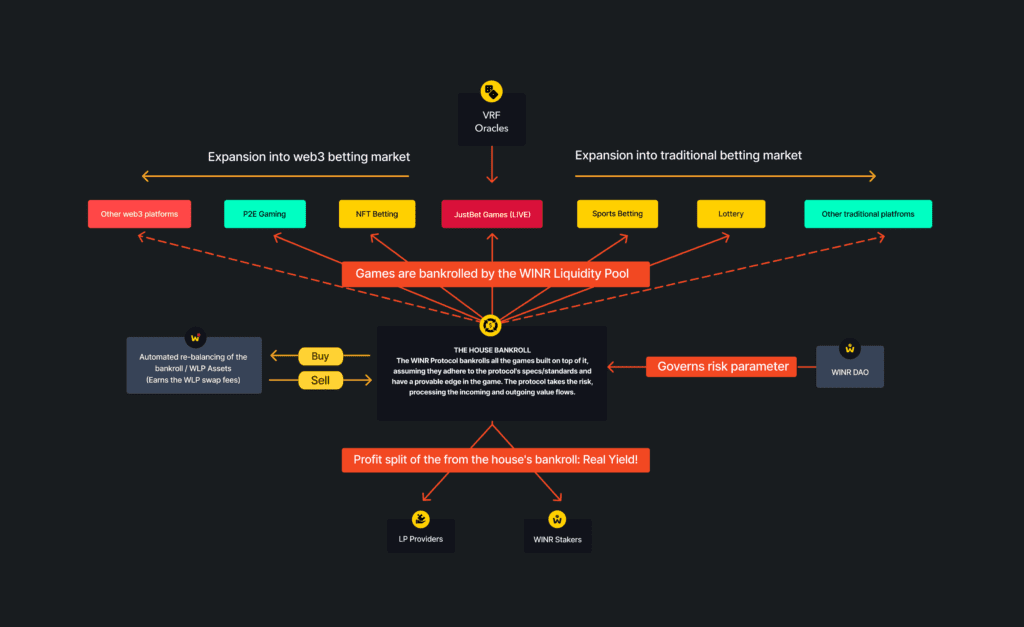

- Provides the liquidity, incentive and game engine infrastructure for developers to build gaming/betting platform on top

- JustBet is the first platform to be built on the WINR protocol (JustBet beta app)

- Platforms built on WINR and plugged into WINR liquidity pool are eligible to reward players with a vested version of the WINR token; vWINR

- Dual token model – WINR, vWINR

- $WINR is the native token used to incentivize developers, liquidity providers, and players

- $vWINR is a vested version of WINR and is minted with each betting transaction

- $vWINR can be converted into WINR through a vesting period of up to 180 days; minimum vesting duration is 15 days

- $WINR and $vWINR can be staked to earn a share of protocol’s revenue in the form of $WLP through the bribes mechanism

- Games are bankrolled by WINR liquidity pool, which consists of an index of assets (DAI, WETH, WBTC)

- Providing liquidity to the WINR liquidity pool mints $WLP tokens

- $WLP represents the underlying assets in the WINR liquidity pool, used as collateral for farming strategies through various vaults

- $WLP tokens could be bought or sold at any time; 0.15% – 0.75% swap fee

- WINR/vWINR emission distribution

- 30% to players in each transaction that calls a game contract connected to the WINR protocol

- 7.5% to liquidity providers in the WLP index composition

- 2.5% to WINR/vWINR staking pool

- Developers who have built games on top of the WINR protocol can propose their games to the WINR DAO to be added to the WINR liquidity pool

- WINR/vWINR holders and stakers having voting rights in the WINR DAO

- Tokenomics

- Token symbol: WINR

- Total supply: 1,000,000,000 (42% WINR / 58% vWINR)

- 10% — Presale (no vesting)

- 37.5% — Ecosystem Rewards (minted over time by players and WLP providers – 100% in vWINR)

- 17.5% — Core Contributors (24 months linear vesting – 100% in vWINR)

- 15% — WINR Labs 6 months cliff, then 36 months linear vesting – 50% WINR / 50% vWINR)

- 7% — Marketing and Partners (24 months linear vesting – 50% WINR / 50% vWINR)

- 5% — Treasury

- 2.5% — Genesis WLP and Early staking rewards (12 months linear vesting – 100% in vWINR)

- 2% — Protocol Owned Liquidity

- 1.5% — Advisors (36 months linear vesting – 50% WINR / 50% vWINR)

- 1% — Previous Holders of WINR (24 months linear vesting – 50% WINR / 50% vWINR)

- 0.5% — Floor Price Fund

- 0.5% — Treasury (100% in vWINR)

- 0.5% — Referral Rebates (minted over time by the referees – 100% in vWINR)

- No taxes